The modern concept of insurance might have started in the 17th century, but consumers and their decision-making processes have changed drastically over time. Modern-day consumers, with the power of the internet at their fingertips, are more informed now than ever before. Prior to making a purchase decision, they extensively research various plans, read reviews about different providers and ask their peers for recommendations. Insurance companies need to adapt to this changing funnel and target their consumers at every stage of the customer journey. Here’s how digital marketing for insurance companies can help brands widen their audience and revamp their marketing strategies.

Cohesive brand message across channels

Insurance companies in India today largely operate in the offline space, both in terms of marketing and operations. When transitioning to digital, companies need to ensure that their branding is cohesive on all platforms. Having a uniform, strong brand image is crucial to improving recall value among customers. All of your future communications, promotions and other marketing activities will depend upon the brand image that your company creates.

In some cases, companies might need to rebrand themselves to adapt to the digital space. If you do decide to update the look and feel of your brand to make it stand out better on digital platforms, you also need to ensure that your offline branding follows suit. Consistency between your online and offline personas is key to creating a strong brand.

Create a comprehensive & performance driven website

When it comes to digital marketing for insurance companies, a website is more than just a tool for branding. While one of the most important uses of a website is to communicate your brand image to your audience, it should also be a useful resource of information for them. When it comes to making a decision about which insurance provider to partner with, customers do so only after carrying out extensive research. The Customer Behaviour and Loyalty in Insurance report by Bain & Company found that more than half of all insurance holders choose a provider only after conducting research on digital platforms. Does your website provide consumers with all the information they need to make a decision?

When developing a website for your insurance brand, you need to ensure that it isn’t just aesthetically pleasing, but is also easy to navigate and user-friendly. Personalisation of home pages is becoming increasingly important for a positive user experience. It’s also important to ensure that the pages are focussed on driving action and driving enquiries or purchases. You can consider creating a login for your customers, which allows them to see details of their plans and customised suggestions based on their needs. It’s also important that you optimise your website with strong SEO techniques to drive organic traffic and gain greater visibility. Apart from supporting your content marketing, local SEO techniques like getting featured on Google Local Listings and Google My Business can help your audience learn more about your company.

Build thought leadership through content marketing

Content marketing is uniquely suited to the marketing needs of insurance brands. Choosing an insurance provider isn’t a quick decision, nor is it a one-time process. Customers need to renew their plans periodically, at which time they can even decide to switch providers. Effective content marketing techniques can help you gain the trust of your audience by establishing your brand as a thought leader in the field. When backed by effective SEO strategies to increase organic traffic and help your content rank higher, content marketing can be one of the most useful ways to reach a wider audience.

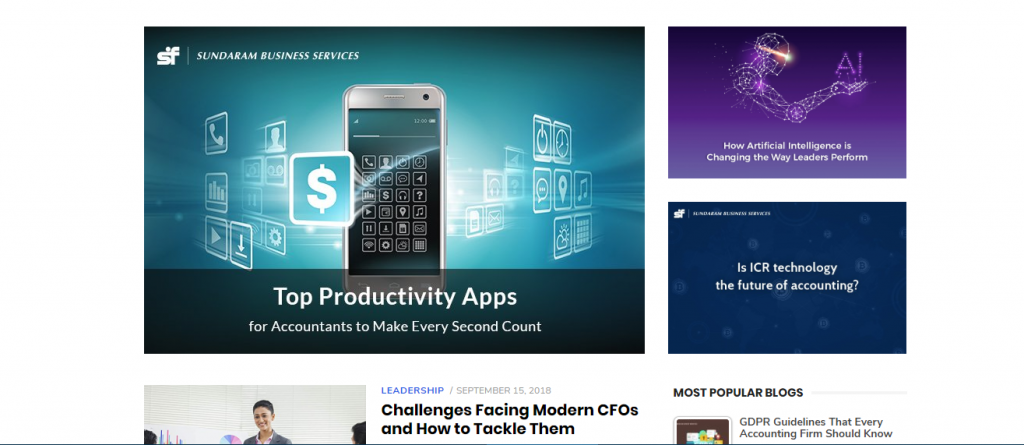

Content marketing can take the form of blog posts, informative videos and how-to guides. This can help engage with your customers right from the awareness stage to acquisition and finally the retention phase. When developing a content marketing strategy it’s important that you think from the perspective of your audience and create content that they will actually find useful. The blog by Sundaram Business Services, for example, doesn’t just have information related directly to their services. Instead, it caters to all related queries that their audience might have. In this way, your customers will be able to recall your brand when they need to choose an insurance provider.

Engage consumers actively on social media

Social media isn’t commonly associated with insurance brands, but it is as important for this segment as it is for any other. There are currently around 240 million Indians on Facebook and this number is only going to grow from here. Insurance, on the other hand, hasn’t penetrated as far in India. Currently, only 20 per cent of women and 23 per cent of men in the country are covered by health insurance. Social media is a powerful way to develop your brand identity and consistently engage with your target audience. Through creative posts, digital marketing for insurance can develop awareness of your product, while at the same time, entertaining your audience.

For Star Health Insurance, we posted a series of quirky posts to highlight the importance of being protected with insurance in an unusual way. This is an excellent example of how out-of-the-box thinking can help social media campaigns for insurance companies gain excellent results.

For some brands, it may be relevant to go after India’s next billion internet users by tapping onto a multilingual content st+rategy. To find out more, find out how we leveraged vernacular content on social media for one of our BFSI Clients, Chola Finance.

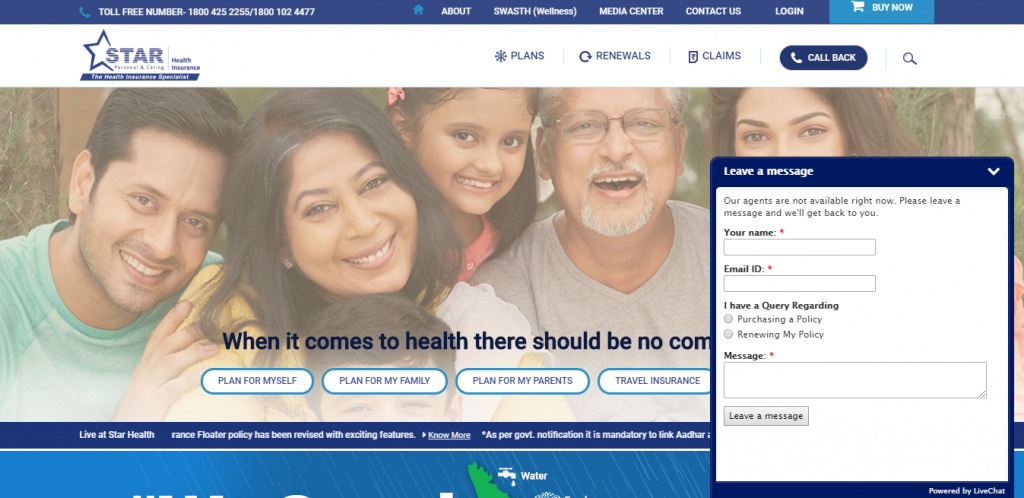

Use chatbots for improved customer service

Large insurance companies typically handle huge volumes of customer queries every single day. The Google India 2017 Year In Search Report revealed that there has been a 64 per cent growth in queries related to motor insurance, which has also been a key driver in generating leads. Timely resolution of these queries is crucial to improve a customer’s experience with your brand and to generate leads. But insurance companies might not always have the manpower to do this effectively. To streamline their processes and handle large-scale customer queries, many insurance brands are turning to AI-powered solutions like chatbots.

As a majority of insurance-related queries are related to broadly similar topics like the price, duration and terms of various insurance plans, chatbots can resolve them much faster than human representatives. But the advantages of chatbots aren’t just for the companies themselves; they go both ways. According to the 2018 State of Chatbots Report, 69% of consumers prefer interacting with chatbots over human customer service representatives.

Leverage digital advertising to acquire leads

Paid advertising can be a fast and effective lead generation tool in digital marketing for insurance companies. There are over 25 platforms available today for insurance companies to advertise their services and gain customers. Some of these include Google Search and Display, LinkedIn, Times Internet, Native and Affiliate ad networks. When coupled with high-performing landing pages, these tools can turn your insurance marketing strategy into a lead generation machine. The advanced targeting options available in digital advertising platforms make it easy for insurance companies to find their target audience online. Companies can target audiences by age, locality and intent, which can help them generate high-quality leads. Since insurance companies are also interested in finding younger audiences to build a relationship with them from the start, advertising on Facebook through video ads, carousel ads and more can help them engage with this segment.

Bijlipay was able to capitalise on the power of Google ads to achieve an unprecedented number of leads in a cost-effective way. They used A/B testing to run different landing pages and altered the copies to communicate with different segments of their audience in a targeted manner. This strategy helped Bijlipay achieve 3,569 conversions at a cost-per-conversion of just Rs. 285. Here are some tips on improving the quality of your leads via digital advertising.

Nurture leads through digital media

Digital platforms have helped to improve the quality of audience targeting and retention in a way traditional media hasn’t been able to. The variety of lead targeting and nurturing methods available today makes it possible to engage with your customers at various touchpoints. In the insurance segment, this is very important to gain new policyholders and to retain existing ones even after their plan expires.

One of the most effective lead nurturing strategies for insurance companies is drip email marketing. With this technique, you can create targeted communications for your customers in every phase of their purchase decision process.

A drip email marketing campaign can be broadly categorised into three phases:

Welcome emails: This is an automated email sent out as soon as a consumer expresses interest in your brand by signing up on your website or filling out a form. A consumer in this stage is usually evaluating various insurance providers and hasn’t made a decision about which one to choose. A welcome email can provide them with details of your company and your USPs, to give them a clearer idea of your brand.

Nurturing emails: The second stage goes deeper to provide consumers with more specific details about your various services, details of your plans and your value propositions. Each of these emails should provide consumers with a clear reason as to why they should convert. The exact number of nurturing emails can vary.

Activation emails: If you have effectively used strong lead nurturing emails, your audience should be ready to convert into actual customers. Activation emails can include a link to sign up for an insurance plan or to get in touch with a representative from your company. These emails include a clear call-to-action which gives your audience the final push to convert.

Apart from email marketing, the introduction of WhatsApp for Business offers insurance companies another medium for lead nurturing. However, since WhatsApp is still largely a personal inbox, companies need to ensure that they keep their communications through this app concise. Sending too many messages to consumers can be seen as spam.

Digital marketing has a number of clear advantages for insurance companies. While this segment has traditionally not been active on digital platforms, it’s clear that making the shift will help insurance companies widen their audience and gain more visibility.